Home / Blog / President Trump - Please Pass Proposed Executive Order 13877 health care sharing ministry as a medical care expense under section 213(d)

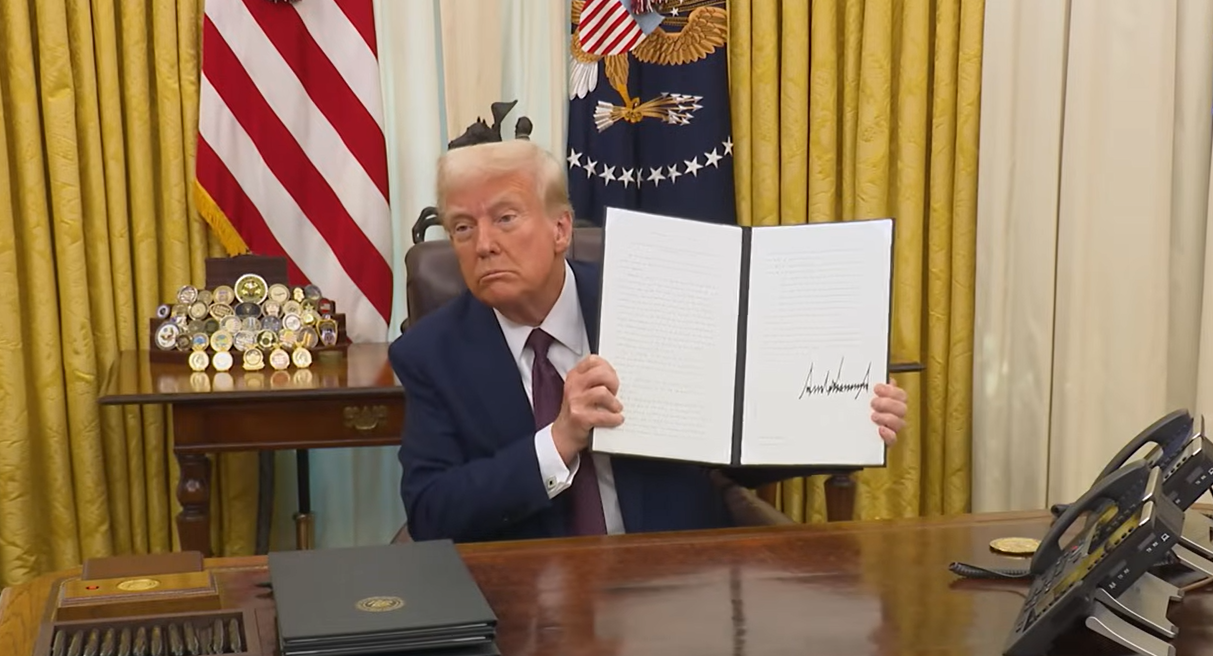

President Trump – Please Pass Proposed Executive Order 13877 health care sharing ministry as a medical care expense under section 213(d)

Proposed Rule provision to integrate HCSM with HRA

The Internal Revenue Service (IRS), Department of the Treasury, has issued a Proposed Rule on the tax treatment of certain medical care arrangements under Section 213 of the Internal Revenue Code (IRC). The published rules are not currently in effect and may change significantly before publication in final form, following a comment period that is open through August 10, 2020.

Executive Order 13877 has been stalled for the entire Biden administration. This addition is long overdue.

Why is this change coming?

On June 24, 2019, President Trump issued Executive Order 13877, “Improving Price and Quality Transparency in American Healthcare to Put Patients First.” In part, the order directs the Treasury to, “propose regulations to treat expenses related to certain types of arrangements, potentially including direct primary care arrangements and healthcare sharing ministries, as eligible medical expenses under Section 213(d).” This proposed regulation fulfills that direction.

When will this take effect?

As currently written in the proposed rule, the new guidance will apply to taxable years beginning on or after a Treasury decision adopting the rules and posting as final regulations in the Federal Register. To view the full Proposed Rule, with a link to submit a comment on it, visit the Certain Medical Care Arrangements document on the Federal Register

Health care sharing ministries

Coming together in community with others holding shared values to help one another with various challenges appeals to a lot of people. In a health care sharing ministry (HCSM), individuals and families pay a monthly fee that goes into a fund to help cover the medical costs of all members. There is usually a co-pay and almost always a required statement of faith that includes substantiation that the member will abstain from immoral and otherwise unhealthy behaviors.

Current guidance

Under the ACA, HCSM premiums are not tax-deductible and are not considered qualifying coverage under the individual or employer mandates, so plan sponsors could not allow employees to integrate HCSM with ICHRA, QSEHRA and other HRAs.

Proposed guidance to integrate HCSM with ICHRA, QSEHRA

The proposed rule makes HCSM premiums and cost-sharing expense deductible under IRC Section 213 and allows plan participants to integrate HCSM with ICHRA, QSEHRA, and other limited HRA designs in an employer-sponsored plan. This is supported by the first paragraph of the proposed guidance, Section 6, Health Care Sharing Ministries, HRAs, and HSAs:

(U)nder these proposed regulations, an HRA, including an HRA integrated with a traditional group health plan, an individual coverage HRA, a QSEHRA, or an excepted benefit HRA, may reimburse payments for membership in a health care sharing ministry as a medical care expense under section 213(d).

HSA contributions disqualified

An HCSM is not a qualifying HDHP for HSA contributions:

Because the proposed regulations provide that health care sharing ministries are medical insurance under section 213(d)(1)(D) that is not permitted insurance, membership in a health care sharing ministry would preclude an individual from contributing to an HSA.