Home / Section 125 Cafeteria Plan Saves Employer Tax Dollars

How a Section 125 Cafeteria Plan Saves Employer Tax Dollars

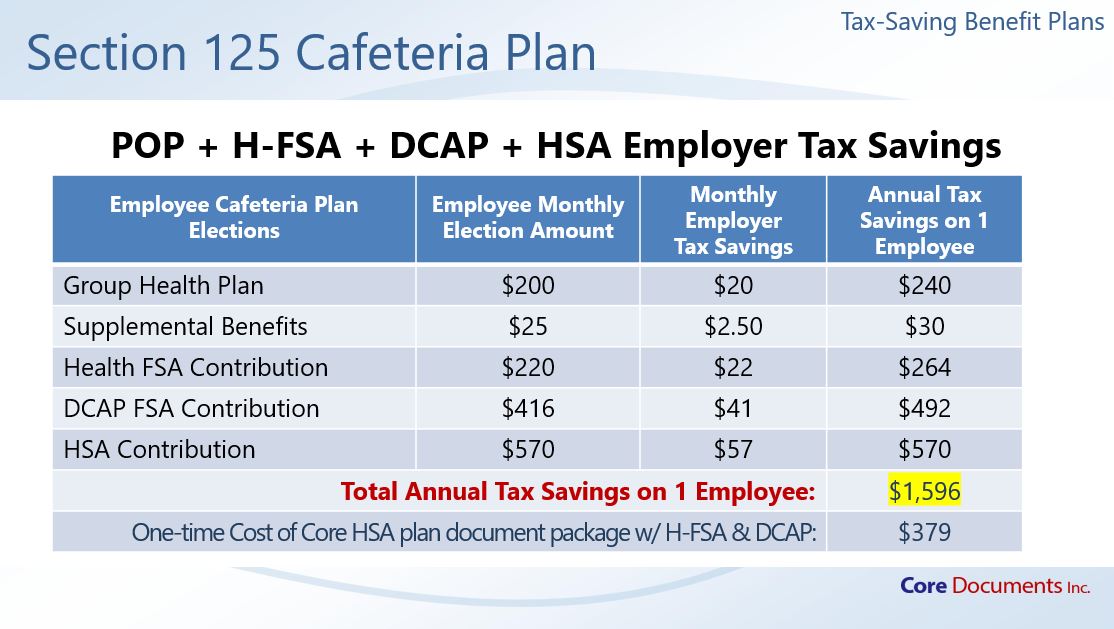

Section 125 Cafeteria Plan: Example of Savings

Cafeteria Plan Savings for Employers

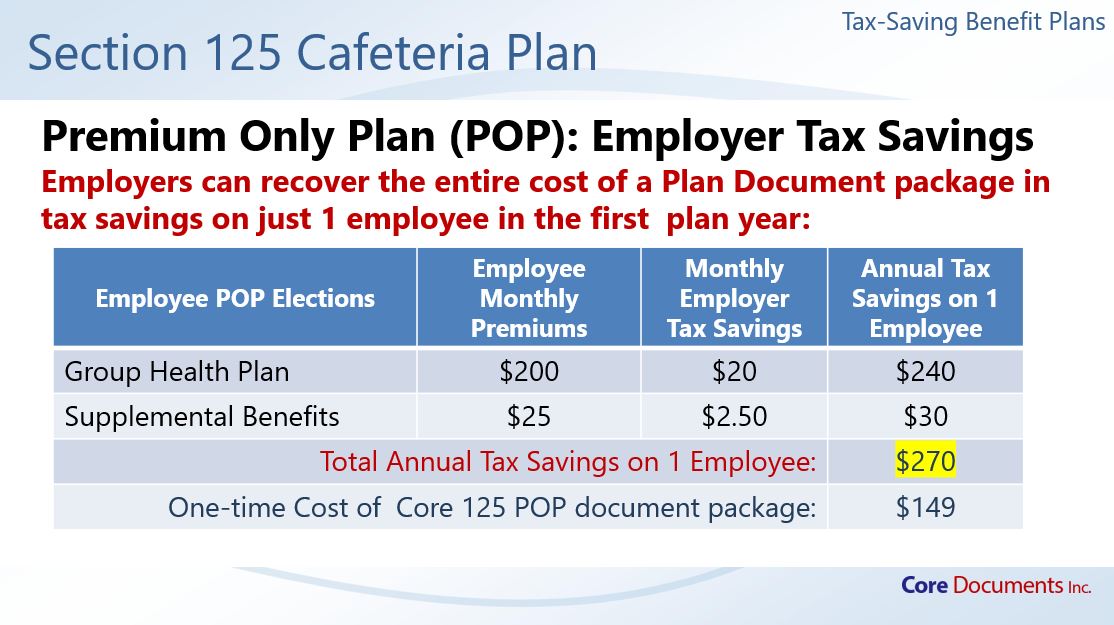

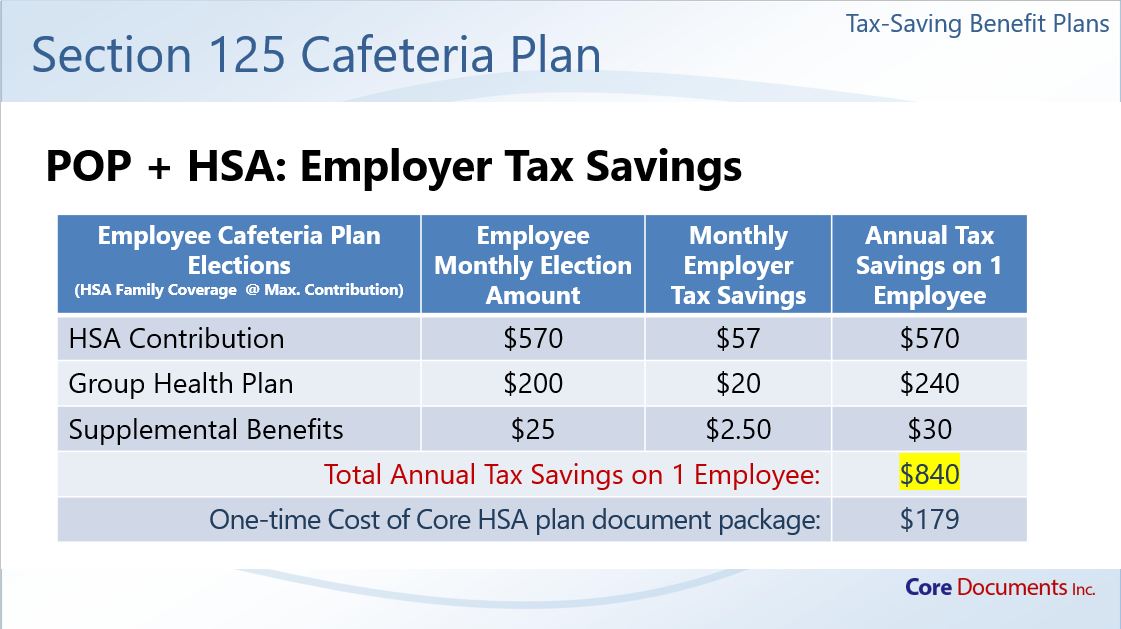

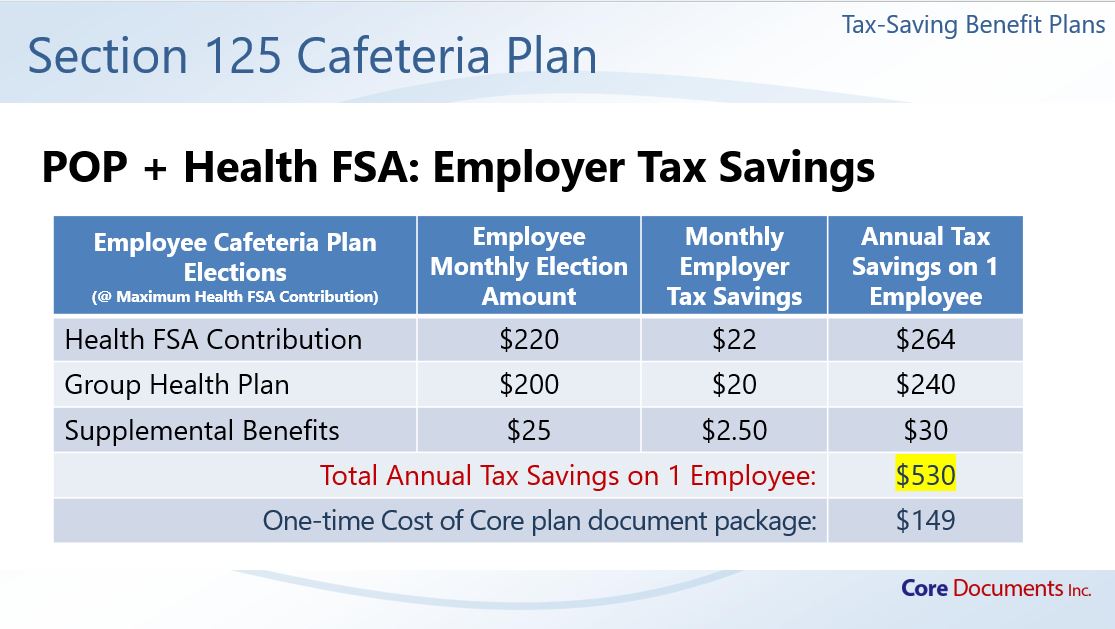

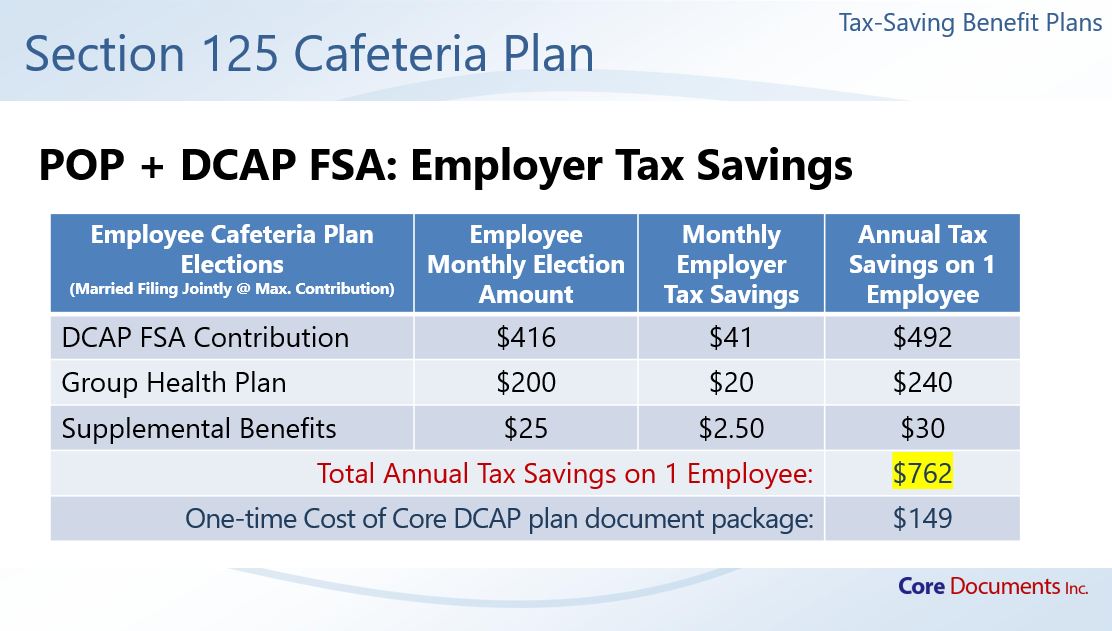

Cafeteria Plans, also known as Section 125 plans, allow businesses to save Social Security (FICA), as well as federal unemployment taxes (FUTA) and generally, state unemployment taxes, on the money employees contribute to their premiums. Employer tax savings can average 7 to 10 percent of employees’ Cafeteria Plan contributions. (A tax advisor should be consulted for information on individual state regulations.)

EXAMPLE: An employer with 20 participating employees, each contributing $3,000 in pre-tax medical or insurance Cafeteria Plan contributions annually.

| Pre-tax Cafeteria Plan contributions: |

$ 3,000 |

| Number of employees: |

x 20 |

| Total employee annual contributions: |

$60,000 |

| FICA factor (Medicare & SS): |

x .0765 |

| Estimated annual FICA savings alone: |

$ 4,590 |

Cafeteria Plan Savings for Employees

Insurance premium contributions and out-of-pocket medical expenses are automatically deducted from employee paycheck before income taxes are taken out. Because their taxable income is reduced by the amount they contribute, employees pay less taxes on the money they earn. Because of the Cafeteria Plan employees see a savings in their FICA, federal, and, in most cases state income taxes. When employees become more aware of how they spend money on benefit items, they also tend to practice more cost-containment, resulting in savings for everyone.

Example of Employee Savings using a Cafeteria Plan:

|

Notice Cafeteria Plan deductions are taken before taxes are calculated moving this employee into a lower tax bracket.

|

With Section

125 |

Without Section

125 |

| Monthly gross pay: |

$3,200 |

$3,200 |

| Pre-tax health insurance premium contribution: |

500 |

0 |

| Pre-tax out-of-pocket medical expenses: |

200 |

0 |

| Taxable monthly income: |

2,500 |

3,200 |

| Applicable income taxes: |

625* |

928* |

| After-tax insurance premium cost: |

0 |

500 |

| After-tax unreimbursed medical cost: |

0 |

200 |

| Net spendable income: |

1,875 |

1,572 |

| Increase in monthly spendable income: |

303 |

– |

| Increase in annual spendable income: |

$3,636 |

– |

*$30,000 ave. tax rate 25% | $38,400 ave. tax rate 29%