Home / Blog / Archive: 2018 Indexed Benefit Figures -- IRS

Archive: 2018 Indexed Benefit Figures — IRS

Looking for 2019 figures? Read: 2019 inflation-adjusted benefit limits for FSA, HSA, QSE-HRA, more

The Internal Revenue Service has released 2018 annual contribution limits for Health Flexible Spending Accounts (FSAs), Dependent Care FSAs, Transit & Parking plans, and Qualified Small Employer Health Reimbursement Arrangements (QSE-HRAs). Most limits were adjusted upward — that means potentially more pre-tax savings for everyone!

These benefit allowances are eligible for annual cost-of-living adjustments (COLA) and come alongside the 2018 limits on Health Savings Accounts (HSAs) released earlier this year. The lone exception is the catch-up provision for HSAs, which remains at $1,000 annually by statute.

An increase in 2018 contribution limits does not mean that an employee or employer must match the increase, only that it is available to them. The same is true of the HDHP deductible and total out-of-pocket limits.

Health Flexible Savings Accounts

The maximum contribution allowed to a Health FSA in 2018 is $2,650; up $50 from 2017.

Dependent Care (DCAP) FSAs

The annual limit for DCAPs stays at $5,000 for 2018.

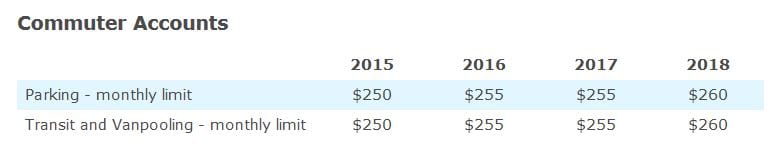

Transit & Parking Plans

Both transit and parking accounts within a Section 132 Transit & Parking plan step up to $260 per month, a $5 monthly increase over 2017.

Qualified Small Employer Health Reimbursement Arrangement

In 2018, employers may contribute up to $5,050 into a QSE-HRA for employees electing single coverage (up $100).

For employees electing family coverage, the 2018 maximum contribution is $10,250 (up $250).

Health Savings Account

2018 contribution limits for HSAs come in three parts:

Contribution Limits

Contributions to an HSA are limited in 2018 to $3,450 for employees with single coverage and $6,900 for those with family coverage. Those figures reflect an increase over the current year of $50 and $150, respectively.

HDHP Deductible Minimum

The employer-sponsored group High-Deductible Health Plan (HDHP) offered with the HSA is required to have an annual deductible of no less than $2,700 for family coverage and at least $1,350 for single coverage, up $100 for families and $50 for individuals.

HDHP Out-of-Pocket Maximum

The out-of-pocket maximum is an amount stated in the HDHP that includes the deductible, co-insurance, and co-pays employees are limited to paying per year. If an employee reaches the out-of-pocket maximum, any further qualifying expense is fully covered by the HDHP. For 2018, the HDHP out-of-pocket maximum is $13,300 for families (up $200) and $6,650 for individuals (up $100).

More 2018 Tax Changes

To read the IRS document, click here. Along with the new contribution limits, you’ll find tax rate tables, personal exemptions, and more valuable 2018 tax information.

Core Documents, Inc. has been providing free consulting, affordable plan documents, and plan updates as needed for Section 125 Cafeteria Plans and Health Reimbursement Arrangements since 1997.