Home / Blog / Video: $149 Tax-Saving Section 125 POP plan document

Video: $149 Tax-Saving Section 125 POP plan document

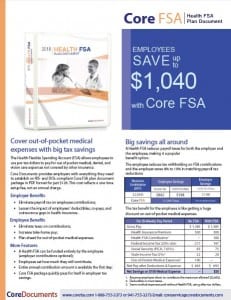

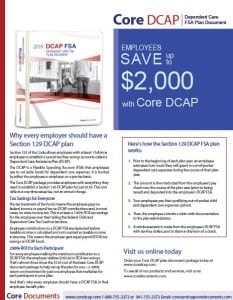

Featuring our most popular product, the tax-saving $149 Section 125 POP plan document package (Core 125), this video explains how employees save up to 40% in taxes while employers eliminate on average 8% of matching payroll tax when the company has a Section 125 POP plan document in place, as required by the IRS to pre-tax benefits.

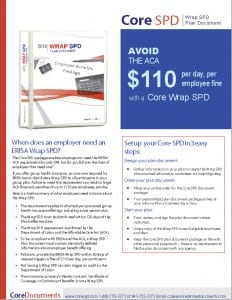

The Section 125 POP plan document package is the first step in building a comprehensive pre-tax cafeteria plan for employees. Employers can provide additional options like the Health Savings Account (HSA), health Flexible Spending Arrangement (FSA), Dependent care plan (DCAP), and a Transit & Parking plan. Core Documents also offers the required ERISA Wrap SPD for all plans.

Getting started with a $149 Section 125 POP plan to pre-tax benefits is easy. Complete our online order form and within 1 business day* your plan document arrives in your inbox.

Click to Order

Once you receive your Section 125 POP plan document, review the information, and sign as indicated. Then, copy the plan SPD for every eligible plan participant and distribute it to employees, along with election forms. Once you are finished with the plan document package, simply file it away with other personnel paperwork. There is no need to file it with any agency, only to keep it on hand for reference and in case of an audit by the IRS or DOL.

*The plan document in .pdf format arrives in your inbox within 1 business day; the printed version of the deluxe binder upgrade (available at $199 — see order form) is shipped the same day via USPS.

More: Section 125 Cafeteria Plan Videos

Download our Section 125 Plan brochures: