Home / Blog / Is medical marijuana an eligible medical expense?

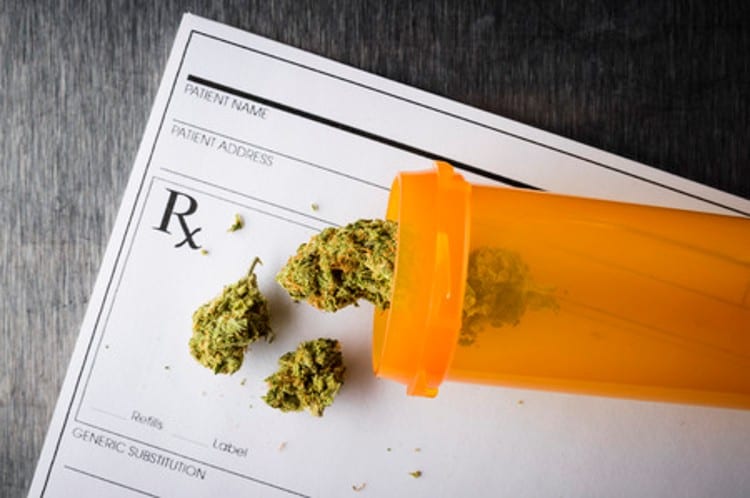

Is medical marijuana an eligible medical expense?

It’s now legal in more than half of U. S. states and the District of Columbia

In 1996, California was the first state to legalize medical marijuana. In 1998, Washington and Oregon joined California to complete the west coast block, along with Alaska. Today, 28 states and the District of Columbia have enacted one or another type of legal mechanism to allow marijuana use for medical purposes (or more).

The legalization of marijuana for medical use has been a blessing to a lot of people. It is known to help with pain from headaches or overly stimulated nerves. It can stem nausea for cancer patients and return an appetite to those suffering chronic diseases and HIV. It helps lessen the occurrence and severity of seizure and muscle spasms. It has become a medical necessity for those individuals suffering these conditions fortunate enough to live in a state that makes the substance available.

It is no surprise, then, that more and more people are asking the question: “Is medical marijuana an eligible medical expense? Can I pay for my prescribed medical marijuana with health insurance benefits?”

The short answer is: “No.”

State vs. Federal Jurisdiction

As you probably know, all of the marijuana initiatives were passed at the state level.

Medical expense eligibility is determined by the federal government.

As you scroll down past list of eligible expenses on IRS Publication 502, Medical and Dental Expenses, you’ll come to the question, “What Expenses Aren’t Includable?”

There you will find the following under the heading, Controlled Substances:

You can’t include in medical expenses amounts you pay for controlled substances (such as marijuana, laetrile, etc.) that aren’t legal under federal law, even if such substances are legalized by state law.

Medical marijuana (and other controlled substances) will not be allowable as a medical expense until the federal government legalizes it, and that doesn’t seem likely any time soon.

For more information on employer-sponsored benefit plan document packages, see:

Section 125 Cafeteria Plan Options for 2018

Post-ACA and 2018 HRA Plan Design Options

Core Documents Releases New 2018 Product Brochures for Tax-Free Benefit Plan Document

Employers: Do you have the ERISA Wrap SPD?