Core Documents releases educational brochures on Section 125 POP

In an ongoing effort to inform employers on the tax-saving benefits and requirements of employer-sponsored group health plans, Core Documents releases educational brochures on the Section 125 Plan Document package and related flex plans. Each brochure has all an employer needs to know to select a plan, order the correct Plan Document package, and then set up the plan.

The Core 125 Premium Only Plan (POP) package provides employers with everything they need to establish an IRS- and DOL-compliant tax-free Section 125 POP. This, in turn, allows employees to pre-tax payments made through the plan to purchase group health insurance and supplemental benefits, as well as contributions to Flexible Spending Arrangements (FSAs) and Health Savings Accounts (HSAs). Pre-tax savings in a Section 125 POP can amount to as much as 40% in income and payroll taxes for employees and 8% to 10% in payroll taxes for employers.

Other brochures in the Section 125 series are:

- Core HSA – Contributions are made on a pre-tax basis to cover out-of-pocket medical costs per IRS Publication 502, Medical and Dental Expenses. Unused funds remain in the account, growing through retirement. Also, adding an HSA to the Section 125 POP allows employers to save more by offering a high-deductible health plan (HDHP) in place of a traditional health plan.

- Core FSA – This is the account most people think of when a Health Flexible Spending Arrangement comes to mind. An FSA can be used alongside an HSA with FSA funds being used first or as a Limited FSA that covers only vision and dental expenses.

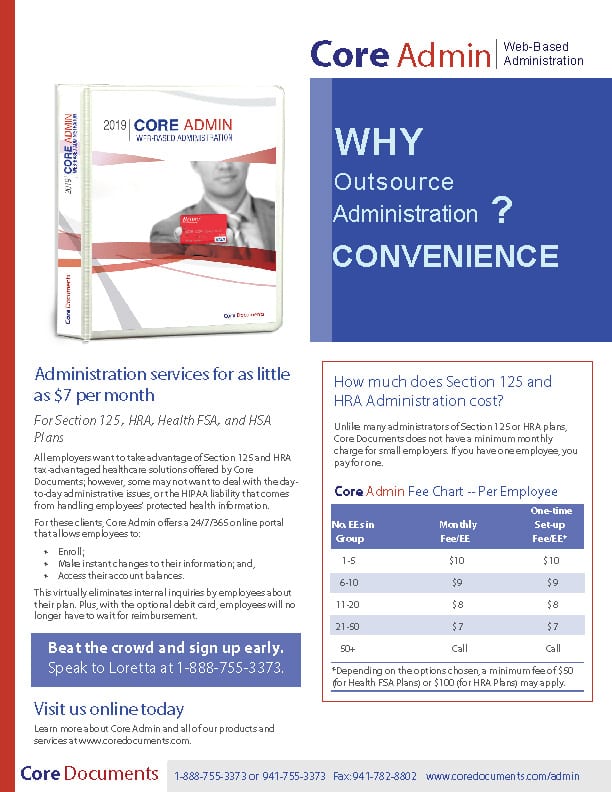

- Core Admin – All of the Section 125 plans (POP and FSAs) come with an employer guide for self-administration, but not every employer wants to deal with the daily claims, account changes, and especially the liability that comes with HIPAA privacy law. For these employers, Core Documents offers the convenience of cloud-based administration for as little as $10 per month.

Core Documents invites you to visit their web site as well as their Facebook page and YouTube channel. The full line of Core 125 brochures is available below. Employers, clients, agents, and our Flex Affiliates are all welcome to download and print as many copies as you wish.

Click on the brochure(s) you wish to view:

(opens in a separate window)

|

|

|

|

Posts related to Core Documents releases educational brochures on Section 125 POP products:

Employers: Update Your Section 125 Premium Only Plan by January 1, 2018

Do I need a Section 125 Premium Only Plan Document?

FSA, HSA, and HRA: What’s the difference?

Helping employers choose the right Health Reimbursement Arrangement (Core HRA brochures)

Latest Blog Posts

- HRA Plan Document Options Available in 2025 For Just $199

- ERISA Wrap SPD Compliance and Plan Design Expert Standing By

- Section 125 Premium Only Plan Document Design Consultants Standing By

- Section 127 EAP Educational Assistance Program & Student Loan Relief plan document

- What the ERISA Wrap SPD must communicate to employees

- ERISA Wrap SPD Plan Document just $149 one-time fee

- President Trump - Please Pass Proposed Executive Order 13877 health care sharing ministry as a medical care expense under section 213(d)

- Tax-free Employee Benefit Plan Document 2025 Brochures

Categories

- Brochure

- COVID-19

- Excepted Benefit HRA (EBHRA)

- Featured Videos

- Group Insurance Wrap SPD

- Health FSA

- Health Reimbursement Arrangements HRA Plans

- Health Savings AccountsHSA Plans

- Individual Coverage HRA (ICHRA)

- Latest Video

- PPACA , ObamaCare and Section 125 & HRAs

- QSE-HRA

- Qualified Small Employer HRA

- Section 125 Cafeteria Plans

- Section 127 Educational Assistance

- Section 129 Dependent Care Assistance Plan (FSA)

- Transit & Parking Qualified Transportation Fringe Benefit

- Uncategorized

- Video